STUCK? STRUGGLING? UNSURE WHAT TO DO?

Get Back in Control of Your Business

If cash is tight, morale is low, and nothing seems to be working — this free Turnaround Toolkit gives you the tools, clarity, and next steps to take action fast. No jargon, no fluff. Just practical help for business owners in distress.

Clarity When You’re Overwhelmed

Know Where You Stand

Our Scorecard helps you instantly assess how serious your situation is — and what your next move should be. No more guesswork.

Fast, Practical Tools

Take Action Today

From cashflow calculators to recovery plans, our tools are built to help you act quickly — even if things feel out of control.

Help from Someone Who's Been There

Real-World Support

This isn’t corporate theory. It’s practical guidance from someone who’s helped businesses recover — and acquired ones worth saving.

FEELING STUCK, LOST, OR BURNT OUT?

When You’re Running on Empty, It’s Hard to See a Way Out

The pressure’s building. Sales are patchy. Cashflow’s tight. You’re tired, the team’s lost focus, and you’re not sure how long you can keep going. Sound familiar? You’re not alone — and you don’t have to face it blind.

SIMPLE FIRST STEP

Take the Turnaround Scorecard and Get Clarity in 5 Minutes

No pitch. No pressure. Just 12 questions to help you understand your situation, where you’re exposed, and what to do next. It’s the starting point for every business we help — and it’s free.

.

WHAT YOU GET

Tools, Clarity, and Practical Support — Without the Fluff

The Turnaround Toolkit gives you exactly what you need to understand your position, stabilise your business, and take confident next steps — even if you feel stuck right now.

Turnaround Scorecard

Where are you exposed — and what should you do next? This quick diagnostic helps you see the full picture fast.

Cashflow Crisis Calculator

Estimate how much runway you’ve got left and when you’ll hit the wall — if you do nothing. A must for decision-making under pressure.

Break-Even Recovery Tool

Figure out what it will actually take to turn the business around — and whether it’s realistic with the time and energy you have.

Recovery Plan Generator

Plug in your Scorecard results and get a personalised action plan in under 10 minutes. Step-by-step, no jargon.

WHO’S BEHIND THIS

Built by Someone Who’s Turned Around — and Bought — Real Businesses

With 30+ years of experience, I've helped owners survive tough times, acquire struggling businesses, and exit on the best terms possible. This Toolkit combines everything I wish I'd had when I was facing the same challenges.

NOT SURE WHERE TO START?

Follow a Proven Recovery Path

Three timelines. One goal.

Whether you need to act fast or stabilise over time, choose from realistic 30, 60, or 90-day recovery plans — with matching tools for every step.

Advisors Use This Too

Supporting Clients Through a Business Exit?

If you're a business advisor, accountant, or consultant helping owners prepare to exit — the Advisor Toolkit gives you everything you need to guide the conversation.Use checklists, diagnostic tools, scripts, and handouts to support your clients with clarity and structure.

NEED A CONFIDENTIAL CONVERSATION?

Let’s Talk — No Pressure, Just Practical Support

If your business is in distress and you’re not sure what to do next, reach out. I offer straightforward, confidential advice — no obligation, no fluff. Whether you’re looking to recover, exit, or explore your options, you’ll get clear direction.

.

YOUR FREE BUSINESS RECOVERY TOOLS

Assess, Act, Recover — Starting Now

Whether you’re on the edge or just feeling stuck, these tools are built to help you make clear decisions fast — no jargon, no downloads, no delays.

Turnaround Scorecard

Purpose:

Assess severity of the situation and recommend focus areas.Format:

12-question multiple choice quiz with scoring across:

Output:

Score range → traffic light system:

Takes 3 minutes. Get instant clarity on your situation.

Cashflow Crisis Calculator

Purpose:

Calculate how long the business can survive under current cash burn.Input:

• Current cash balance

• Monthly income

• Monthly fixed costs

• Monthly variable costs

• Outstanding debtor £

• Outstanding creditor £

Output:

• Burn rate

• Days of cash runway

No download. See your burn rate and runway in seconds.

Break-Even Recovery Tool

Purpose:

Determine how much revenue the business needs to cover costs again.Input:

• Monthly fixed costs

• Gross margin %

Output:

• Monthly break-even sales

Quick and simple. Know your sales target to stay afloat.

Recovery Plan Generator

Purpose:

Turn your situation into a personalised 5-step recovery plan.Input:

• Scorecard results or direct user input

• Select urgency level

• Choose key challenge areas

Output:

• Tailored 5-step recovery plan based on urgency

• Supportive messaging and practical action steps

Get a personalised 5-step plan — no sign-up needed.

Real-World Recovery. Not Just Theory.

The 12-Week Restructuring Workbook

If your business is under serious pressure, this isn’t just another download — it’s a step-by-step survival and reset plan.

Work through cash triage, team clarity, customer focus, and weekly actions designed to get you stabilised, refocused, and back in control — one step at a time.

.

YOUR FREE BUSINESS RECOVERY TOOLS

Free Tools & Resources to Support Your Turnaround

Practical, no-fluff documents to help you stabilise cashflow, make tough decisions, and regain control during a business crisis. Download and use any resource below — no sign-up required.

Triage & Stabilisation Phase

Focus: Cashflow, creditor pressure, urgent steps

Business Turnaround Workbook

A practical, step-by-step workbook to diagnose problems, clarify priorities, and build a recovery plan.

Debtor Collection Templates

Three email templates for chasing overdue payments professionally.

Communication Template – Creditor Standstill Request

Request breathing space from creditors during crisis.

Debt Prioritisation Worksheet

Triage what bills to pay and who to call first.

Cashflow Crisis Checklist

Immediate actions to review, prioritise, and protect your cash.

HMRC Time to Pay Guide

How to request a payment arrangement and avoid penalties.

Bank Communication – Financial Update and Request

Open lender dialogue for short-term support.

Communication Template – Supplier Negotiation

Request extending / renegotiating terms from suppliers during crisis.

Creditor Communication Guide

How to speak confidently with suppliers, HMRC, and lenders when you’re under pressure.

Supplier Negotiation Framework

What to ask for, how to ask, and how to preserve the relationship.

Landlord Communication – Rent Support Request

Negotiate rental flexibility or deferment.

Short-Term Planning & Control

Focus: Survival strategy, 30–90 day planning

Crisis Communication Checklist

Who to speak to, what to say, and how to keep people informed.

Short-Term Survival Plan Template

Map out the next 30 days with clarity and focus.

Credit Control Script and Tipsheet

Recover overdue invoices faster.

Debt Prioritisation Matrix

A tool to decide which bills to pay, delay, or renegotiate.

12-Week Recovery Planner

A structured weekly planner to rebuild momentum.

.

Weekly Business Reset Template

A simple weekly reflection tool to stay on track during recovery.

Staff Communication – Restructuring Announcement

Clear messaging for internal morale and stability.

Strategic Recovery & Rebuild

Focus: Exit, restructure, customer and team focus

Turnaround or Exit Decision Guide

Helpful prompts to decide whether to fight, sell, or walk away.

Refinancing Options Guide

A plain-English overview of short-term funding and refinancing options.

Post-Crisis Rebuild Checklist

A checklist to refocus and strengthen after the worst has passed.

What Does a Turnaround Consultant Do?

Demystify external help — when, why, how.

Customer Retention During Crisis

How to support and retain your best customers when things are tight.

Strategic Recovery & Rebuild

Focus: Owner mindset, self-care, decision clarity

Owner Self-Care & Resilience Guide

Tools to protect your energy, mindset, and decision-making capacity.

Owner Stress Management – Tipsheet for Tough Times

Keep your head clear and energy steady.

Directors' Legal Duties in Distress – Plain English Guide

Avoid wrongful trading or personal liability.

Feeling overwhelmed?

Realistic Recovery Paths for Distressed Businesses

Not sure where to start? Choose from three practical turnaround timelines based on your urgency. Each path gives you the key actions to stabilise and rebuild.

Triage & Stabilisation Phase

Section 1: 30-Day Survival Plan

Assess immediate cashflow and create a short-term survival forecast

Pause unnecessary spending and cancel non-essential outgoings

Contact key creditors and request standstill or payment plans

Informally communicate with staff and critical suppliers

Start tracking every pound in/out daily

Protect the core business activities only

Seek initial advice from an advisor or turnaround specialist

Survival & Triage Plan

Short-Term Planning & Control

Section 2: 60-Day Stabilisation Plan

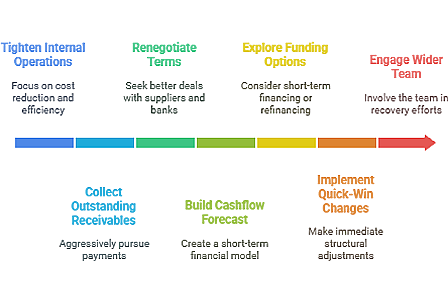

Tighten internal operations: costs, credit control, working capital

Collect outstanding receivables aggressively but professionally

Renegotiate rent, supplier terms, bank facilities where possible

Build a short-term cashflow forecast (13-week model)

Explore short-term funding or refinancing if needed

Implement any quick-win structural changes (e.g. shift patterns, pricing)

Begin engaging wider team in recovery efforts

Stabilisation & Control

Strategic Recovery & Rebuild

Section 3: 90-Day Recovery Plan

Set clear goals: reduce losses, return to breakeven, or prepare for sale

Evaluate unprofitable products, services, contracts — consider exit

Review team roles and right-size if needed

Formalise key plans: operations, debt repayments, customer strategy

Monitor weekly cashflow and monthly results vs targets

Explore new revenue channels or diversification opportunities

If recovery isn’t working, explore formal restructuring or sale options

Restructure & Rebuild

❓ Frequently Asked Questions

1. Should I keep trading or shut the business down?

If the business is still generating income and has core potential, stabilisation might be possible. If liabilities far outweigh assets and trading worsens the position, seek professional advice immediately.

2. What happens if I stop paying my suppliers?

Some may pause deliveries or take legal action. Others may be open to negotiation if you communicate early. Don’t ignore them — use the templates in the toolkit to explain and ask for time.

3. Can I just pay who I want first?

No. Prioritising one creditor (like a friend, family member, or yourself) over others when insolvent could be classed as preferential treatment — and reversed later. Use the debt prioritisation worksheet instead.

4. Is it wrong to keep trading if I know we’re in trouble?

If you reasonably believe there's a path to recovery and you're acting in the best interests of creditors, you're within your rights. But if you know there's no way to pay everyone, you must stop and seek advice.

5. Will HMRC give me time to pay?

Yes, often. HMRC is one of the more structured creditors and may agree to a formal Time to Pay plan. Use the included HMRC guide to approach them professionally.

6. What if I can’t pay staff this month?

Staff are a top priority. If you know you can’t meet payroll, speak to them early and explore emergency funding or a payment plan. Avoid silence — it creates panic and legal exposure.

7. I’m exhausted. How do I make good decisions in this state?

You don’t need to do it all alone. Use the checklist tools to create structure. Take one action per day. Clarity builds as momentum returns. The Owner Stress Tipsheet in the Toolkit can help you reset.

.

KNOW WHERE YOU STAND

Take the Turnaround Scorecard

If you're feeling pressure in your business but aren't sure how bad things really are, this scorecard gives you a structured way to assess it. No second-guessing — just a clear view of where you stand and what needs attention.

.

REALITY CHECK, MADE SIMPLE

How Long Can Your Business Survive?

This tool helps you work out how much cash runway you really have based on your current income, costs, and unpaid invoices.

It’s quick, confidential, and surprisingly clarifying — especially when stress levels are high and decisions need to be made fast.

.

FIND YOUR MINIMUM SALES TARGET

What Do You Need to Sell Just to Survive?

This tool calculates the revenue you need to bring in each month just to cover your costs — no profit, no losses. It’s a vital number for any business under pressure.

Enter your costs and gross margin to see your monthly break-even point, fast.

.

FEELING STUCK AND UNSURE WHAT TO DO NEXT?

Generate a Personalised 5-Step Recovery Plan

If your business is under pressure, clarity matters. This free tool asks a few quick questions and gives you a tailored action plan to help stabilise your business, reduce stress, and move forward with focus — no fluff, no theory, just practical next steps.

Practical Guide

How to Turn Around a Failing Business

A step-by-step overview of how to stabilise a struggling business — including where to start, what to prioritise, and how to rebuild momentum. read article...

Tool Roundup

Best Business Turnaround Tools to Save Your Company

From cashflow tracking to creditor negotiation templates — this guide highlights the most effective tools to help turn the tide fast. read article...

Owner Insight

Cashflow Crisis? Here’s a Simple Response Plan

Running out of cash is the number one killer. Here’s how to respond quickly, reduce panic, and give yourself breathing room. read article...

Explainer

Debt Restructuring Options for SMEs

If creditors are closing in, you may have more options than you think. This article explains what’s available and how to approach it. read article...

Strategy

Corporate Restructuring vs Insolvency

Not sure if you need to restructure or wind down? This guide walks you through the key differences and implications of each route. read article...

Crisis Response

What Is Troubled Debt Restructuring?

If your lenders are open to negotiation, this article helps you understand how troubled debt restructuring works — and when it applies. read article...

How to Turn Around a Failing Business Step by Step

When you’re facing a downturn or feeling like your business is slipping through your fingers, it’s hard to know where to start. Most owners wait too long — caught between panic and paralysis — until cash dries up or key people walk away.This guide is designed to cut through the fog and help you take meaningful steps, even if things feel like they’re at breaking point. Because the truth is: turnarounds are possible. But they require speed, honesty, and structure.Step 1: Stop the Bleeding

Start by stabilising cash. Forget profits for now — survival is the priority. This means:Pausing non-essential spending

Speaking with creditors about payment plans or time-to-pay agreements

Getting clear on your weekly cash position (not monthly)

Prioritising only the activities that bring in cash fast

A simple 13-week rolling cashflow forecast can be a game-changer. This gives you control — and lets you plan short-term decisions with confidence.Step 2: Get Real With the Numbers

Many owners work off gut feel. But when things are tough, you need clarity.

Pull together your last 12 months’ P&L, balance sheet, and a snapshot of current debt and liabilities. This doesn’t need to be perfect, but it needs to be honest.Ask:

What’s really profitable?

What’s draining time, energy, or cash?

Are we pricing correctly — or undercharging just to win work?

This clarity can be confronting — but it’s essential.Step 3: Rebuild the Core

You don’t fix a business by doing more of everything — you fix it by doing less of what doesn’t work and doubling down on what does.

Look at your existing customer base. Can you:

Upsell more to existing clients?

Build recurring revenue or longer-term contracts?

Cut low-margin work or unprofitable products?

Sometimes the biggest breakthroughs come from trimming fat and simplifying the business model.Step 4: Fix What’s Broken Internally

Turnarounds aren’t just about cash — they’re about confidence. Staff, suppliers, and even customers can smell stress.Take a look at:

Broken systems or processes

Owner bottlenecks (where you’re doing too much)

Communication issues in the team

Even small improvements here can free up capacity and rebuild momentum.Step 5: Get Support — Fast

This is not a journey to walk alone. A solid turnaround plan can’t live in your head — and it’s not something your accountant can fix with year-end accounts.You need:

A short-term action plan (30–90 days)

A sounding board or advisor who understands turnarounds

A clear set of metrics to track weekly

Start with our free Turnaround Toolkit — packed with tools, guides and templates — to get moving fast.What to Do Next

If you’re feeling stuck or unsure what shape your business is really in, try our free Business Recovery Scorecard. It takes 5 minutes and gives you a personalised risk profile across key areas.

From there, you’ll know whether you can fix things internally — or whether it’s time to speak to someone.

You can turn it around. But you’ve got to move before the window closes.

Best Business Turnaround Tools to Save Your Company

When your business hits a rough patch, it’s not just strategy that matters — it’s execution. And execution gets a whole lot easier when you’re using the right tools.In a turnaround situation, time is tight, emotions run high, and cash is usually low. That means every tool you use needs to save time, improve decision-making, or drive immediate results. Here are some of the best practical tools to help stabilise, restructure, and rebuild your business.1. 13-Week Cashflow Forecast Template

Why it matters: Cash is the oxygen of your business.

This simple spreadsheet (which you can build in Excel or Google Sheets) tracks your weekly inflows and outflows over a rolling 13-week period. It helps you:

See when cash gaps are coming

Plan supplier payments and staff costs more clearly

Make better decisions under pressure

This should be updated every week — not monthly — and form the foundation of all turnaround decisions.2. Creditor & Debtor Tracker

Why it matters: You can’t negotiate what you can’t see.

List every supplier you owe and every customer that owes you. Include:

Amount owed

Terms agreed

Contact details

Priority rating (e.g. critical, negotiable, low-risk)This makes it easier to:

Re-negotiate payment terms

Prioritise who to pay

Spot where money is tied up unnecessarily3. Breakeven Calculator

Why it matters: If you don’t know your breakeven point, you’re flying blind.

A breakeven tool helps you figure out:

How much you need to sell to cover costs

What happens if prices go up or down

Whether your margins are sustainable

This is critical if you’re planning to cut costs, raise prices, or shrink the business to survive.4. Turnaround Priority Matrix

Why it matters: In a crisis, everything feels urgent. This tool helps you filter the noise.Draw up a 2x2 matrix:

Axis 1: Urgent vs Not Urgent

Axis 2: High Impact vs Low Impact

Plot every task or issue you're facing. Focus your limited energy on things that are Urgent + High Impact first.

This helps avoid panic-led decision-making and keeps the team focused.5. Turnaround Toolkit

Why it matters: You need structure, fast.

The Turnaround Toolkit includes guides, templates, and scorecards to help you:

Understand where the risk really is

Take action in the right order

Communicate clearly with staff, creditors, and stakeholders

It’s designed to get you moving even if you feel overwhelmed or unsure where to start.Final Thought

Tools don’t save businesses — decisions do. But the right tools make those decisions faster, clearer, and less emotional.

If you’re not sure where to begin, start with the 13-week cashflow forecast and the Business Recovery Scorecard. You’ll gain instant clarity and a baseline to work from.

From there, the tools above can help you regain control — and momentum.

Cashflow Crisis? Here’s a Simple Response Plan

When cash is tight, panic sets in. It’s the number one reason businesses fail — not lack of profit, but running out of cash at the wrong moment.If you’re facing a cashflow crunch, you don’t need complicated strategies. You need a simple, clear plan that gives you breathing space and buys time to reset. Here's how to do just that.Step 1: Know Your Cash Position

You can’t fix what you can’t see.

Immediately create or update your 13-week cashflow forecast. This gives you a week-by-week view of what’s coming in and going out, and lets you:

Spot shortfalls before they hit

Prioritise key payments

Make confident decisions under pressure

Tools like Google Sheets or Excel work fine. Just make sure it’s updated weekly.Step 2: Cut Fast, Not Deep

Now’s not the time for "nice-to-haves."

Go through your bank transactions and cancel or pause anything that isn’t:

Generating revenue

Keeping the business legally compliant

Supporting core operations

This includes subscriptions, software, travel, outsourced services, or perks. Focus only on what keeps you alive.Step 3: Talk to People

Silence creates fear. Most suppliers and creditors will work with you if you talk to them early.

Contact HMRC for a Time to Pay agreement

Ask suppliers for extended terms or staged payments

Speak with landlords about deferment or short-term reductions

You don’t need to show weakness — just clarity and intent. Most will appreciate the transparency.Step 4: Chase Every Pound

Now flip the lens: what’s owed to you?

Get a list of all outstanding invoices and:

Call, don’t email

Offer payment plans if needed

Consider early payment discounts

Speed is your friend here. Even small amounts can plug short-term gaps.Step 5: Rebuild Trust Internally

Cashflow problems ripple through teams. Be honest with staff.

You don’t need to give away every number, but explain:

What’s happening

What you’re doing about itHow they can help

A united team can survive almost anything. A confused or fearful one will fall apart.Bonus: Use the Toolkit

If this feels overwhelming, grab the Turnaround Toolkit. It has step-by-step guides, cash trackers, and templates to:

Manage creditors and debtors

Build your 13-week forecast

Plan your recovery actions

It’s free, practical, and built for situations just like this.What to Do Next

Take 5 minutes and complete the Business Recovery Scorecard. It gives you a snapshot of your risk across key areas.

You’ll get a custom report instantly — and it might be the first time you’ve seen the real picture.

From there, you can decide if you can handle this solo — or if you need support.

Debt Restructuring Options for SMEs

If you’re drowning in bills, loan repayments, or supplier demands, it can feel like there’s no way out. But there usually is.Debt restructuring isn’t just for big corporations or insolvency firms. Small and mid-sized businesses can renegotiate terms, restructure liabilities, and reset the balance sheet — without going under. This article walks you through your main options.What is Debt Restructuring?

It’s the process of renegotiating your existing debts to improve terms and reduce short-term financial pressure.That might include:

Lowering monthly payments

Extending repayment periods

Consolidating debts

Deferring payments temporarily

The goal? Free up cash and avoid default.Option 1: Time to Pay Arrangements (HMRC)

If you owe tax (VAT, Corporation Tax, PAYE), HMRC may agree to a structured repayment plan.How it works:

You propose a realistic payment schedule

They assess your financials and history

If approved, penalties stop and you repay over 3–18 months

Tip: Always speak to them before missing a payment. HMRC is much more helpful when you engage early.Option 2: Supplier Payment Plans

Many SMEs owe significant amounts to suppliers. These are often negotiable.What to do:

Be proactive and transparent

Offer a clear repayment proposal (e.g. 50% now, 50% over 2 months)

Stick to what you promise

Maintaining relationships while easing pressure is key. Don’t ghost them. Communicate.Option 3: Loan Refinancing or Consolidation

If you’ve got multiple loans or high-interest credit facilities, refinancing might reduce repayments.Possible options:

Extend loan term to reduce monthly cost

Consolidate multiple debts into one facility

Switch to lower-interest borrowing (if your credit allows)

Speak with your bank or a commercial finance broker. Even if rates are higher now, cashflow relief may be worth it.Option 4: Informal Arrangements With Lenders

If you’re behind on repayments, some lenders may agree to a short-term restructure.What to say:

Explain the situation factually

Share your cashflow forecast

Propose a reduced or deferred payment schedule

This can prevent default and protect your credit profile.Option 5: Company Voluntary Arrangement (CVA)

This is a more formal option, typically managed by insolvency practitioners. It involves legally binding agreements with creditors to repay part of your debts over time.When to consider:

You’ve explored informal options and still can’t meet obligations

You want to avoid liquidation or administration

It’s complex, but can be effective. Always seek advice first.Where to Start

Debt doesn’t have to mean disaster. But it does require action.Start with:

A creditor and debtor tracker

A 13-week cashflow forecast

Open, honest conversations with your creditors

And if you’re not sure what level of risk you’re really carrying, try our Business Recovery Scorecard. It’s free and gives instant clarity across five key risk areas.Final Word

Restructuring isn’t weakness. It’s smart. It’s about protecting the core of your business and giving yourself room to breathe.You can rebuild from here. But only if you move quickly and communicate clearly.

Corporate Restructuring vs Insolvency

If your business is under pressure, you may be asking yourself: Should I restructure or is this business actually insolvent?It’s a scary question, but the difference matters — and knowing which path you’re on will shape your next moves. This article will help you understand the key differences and which approach fits your situation.What Is Corporate Restructuring?

Restructuring is about fixing the business before it fails. It focuses on:

Streamlining operations

Cutting costs

Renegotiating debt

Changing leadership, ownership, or structure

It’s proactive. It assumes the business still has a viable core, but needs a reset to become profitable again.

Restructuring can be informal (led by the owner or management team) or formal (involving outside advisors or third-party funders).What Is Insolvency?

Insolvency means your business can’t pay its debts when they fall due, or your liabilities exceed your assets. At this point, directors have legal responsibilities to act in the best interest of creditors.There are two types:

Cashflow Insolvency — Not enough cash to pay bills

Balance Sheet Insolvency — Liabilities exceed assets

Insolvency doesn't always mean immediate shutdown — but it often triggers a need for formal processes, like:Company Voluntary Arrangement (CVA)

Administration

LiquidationHow to Know Which You Are

Ask these key questions:

Are we able to meet our financial obligations (wages, suppliers, HMRC)?

Is our business model fundamentally sound if we cut costs or improve operations?

Have we already breached loan covenants or received statutory demands?

Are we losing key staff, customers, or suppliers due to uncertainty?

If your answers show short-term cash issues but long-term viability, you’re likely a candidate for restructuring.

If you’re defaulting on payments, running out of options, and have no visibility on cash beyond 2–3 weeks — you may be insolvent.What If I’m Not Sure?

Don’t guess. Directors can be held personally liable for wrongful trading if they continue trading while insolvent.Here’s what to do:

Create a 13-week cashflow forecast

Map your liabilities and debt obligations

Speak with a turnaround advisor or licensed insolvency practitioner

The earlier you act, the more options you have.Recovery vs Closure: Timing Is Everything

Most businesses wait too long. Restructuring works best before insolvency bites.Signs you can restructure:

Still have paying customers

Core product/service is in demand

Costs can be trimmed fast

Staff are still engagedSigns insolvency may be approaching:

Legal demands or winding-up petitions

HMRC refusing further delays

Cash burn with no clear way to plug itTake the Pressure Off

If you’re feeling overwhelmed, try our Business Recovery Scorecard. In under 5 minutes, it gives you a traffic-light risk profile and tailored guidance based on your answers.

Whether you’re heading for a reset or a formal process, clarity is your first step.Final Thought

Insolvency is not the end of the road. But it does mean a different road.Restructuring, on the other hand, is about fighting back before the options run out. Know where you are. And act while you still can.

What Is Troubled Debt Restructuring?

If you're behind on repayments or struggling with unmanageable debt, you may come across the term "troubled debt restructuring" (TDR). It's a formal-sounding concept, but at its core, it's a way for lenders and borrowers to find a workable solution when financial distress sets in.This article explains what TDR is, when it applies, and how it can be used in a business context.Definition: What Is TDR?

Troubled Debt Restructuring occurs when a lender modifies the terms of a debt agreement because the borrower is experiencing financial difficulties. The modification is typically more favourable to the borrower than originally agreed.These modifications can include:

Reducing the interest rate

Extending the term of the loan

Forgiving part of the principal

Accepting interest-only payments for a period

The key distinction is that the lender wouldn’t normally offer these terms unless the borrower was in financial distress.Why Would a Lender Agree to This?

It’s about damage control. If the borrower defaults or enters insolvency, the lender might recover far less — or nothing at all.By renegotiating, they:

Preserve the relationship

Increase chances of recovering most or all of the debt

Avoid costly legal proceedings or write-offs

So while TDR is a sign of stress, it’s also a sign of cooperation.When Does It Apply to Small Businesses?

TDR is more common than you think in the SME space — it just doesn’t always carry the same label.You might already be engaging in informal TDR if:

You’ve agreed a payment holiday with your lender

You’ve refinanced an overdue loan on easier terms

A supplier has let you roll over aged debt without penalty

The difference is formality and documentation. True TDR often involves written agreement and disclosure (especially in accounting).Accounting Implications

If you're preparing formal financial statements or seeking funding, it's important to account for TDR correctly.

For example, if a portion of debt is forgiven, it may appear as income in your accounts. This can affect your tax position, borrowing capacity, or valuation.

Always speak to an accountant before finalising any restructuring.Is TDR a Red Flag?

Not necessarily. It's a signal of past distress, but it can also be a sign of effective negotiation and forward planning.

In fact, many turnaround professionals use TDR as a tool to buy time and reset the business model. The key is what you do with the breathing space it creates.How to Pursue It

If you think a lender might consider TDR:

Prepare your 13-week cashflow and financial overview

Be honest about your challenges, but clear about your plan

Propose realistic terms that help you recover while honouring the debt

It’s not a free pass — but it might just be the bridge you need.Final Word

TDR is about flexibility and survival. It’s not something to be ashamed of — it’s a tool to navigate tough terrain.Start with clarity. Use the Business Recovery Scorecard to assess your current state, and lean on the templates in the Turnaround Toolkit to open the right conversations.

You’re One Step Closer to Turning Things Around

Thanks for taking the first step — it takes courage to face tough situations head-on.

Struggling doesn’t mean failing. The right tools, mindset, and action plan can shift things faster than you think. And you don’t have to do it alone.